Here’s our quick note which attempts to synthesize the saga of Indian Markets from 23 March, 2020 to 13th July, 2020.

Nifty made a bottom of 7610 on 23rd March and since then has not looked back. It’s been a sharp V-shape recovery on the indices leading to an absolute return of 42% as of 13th July (closing level – 10802). Let’s leave the Economy out of this equation for the time being. Markets don’t seem too worried about the economy and for a change, we are also leaving it for another discussion, another day.

Nifty in these 112 days is up by a massive 41.9%.

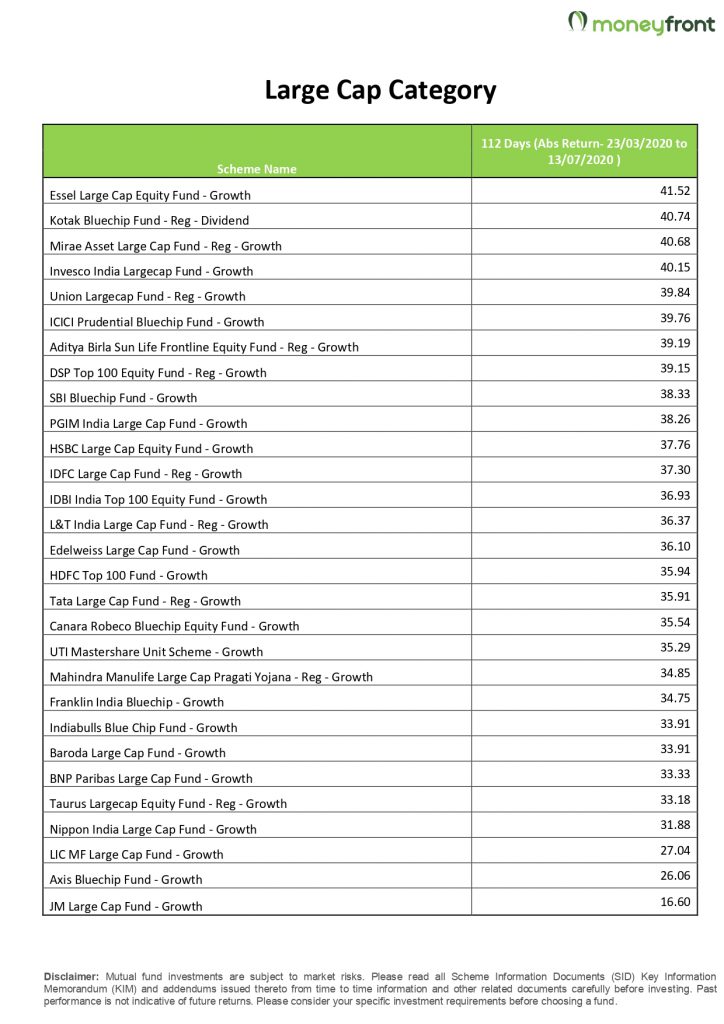

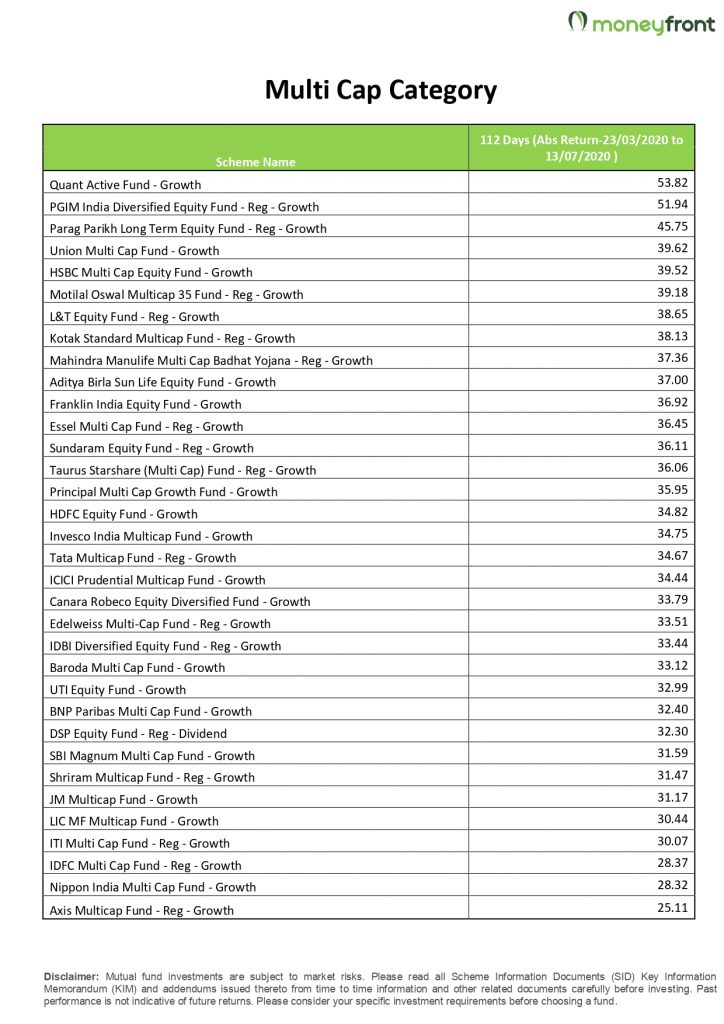

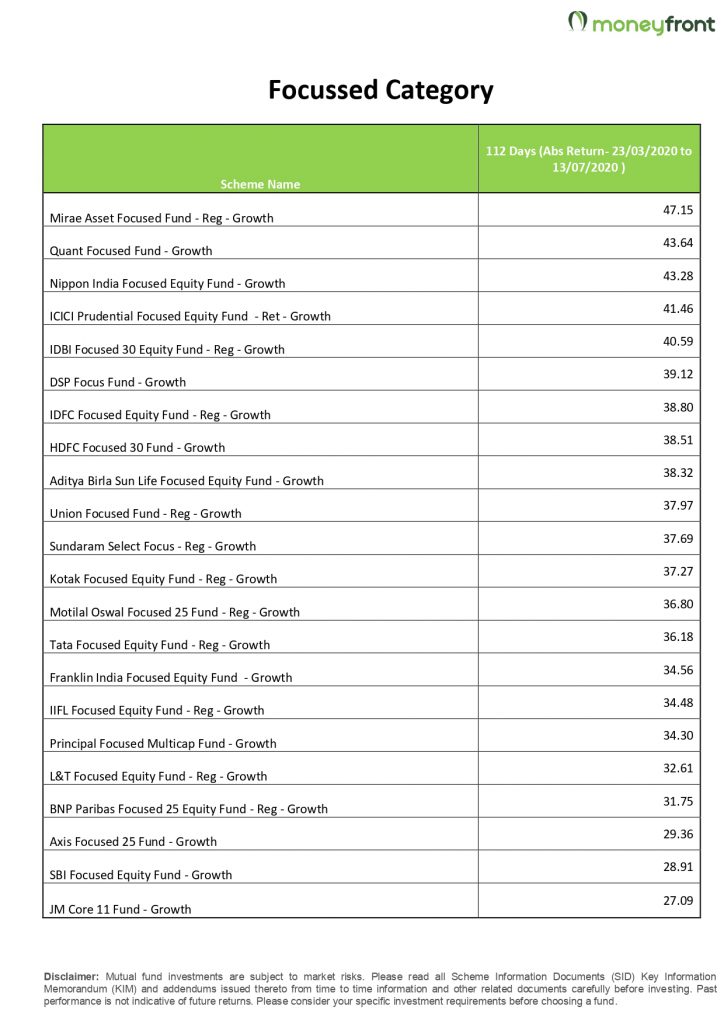

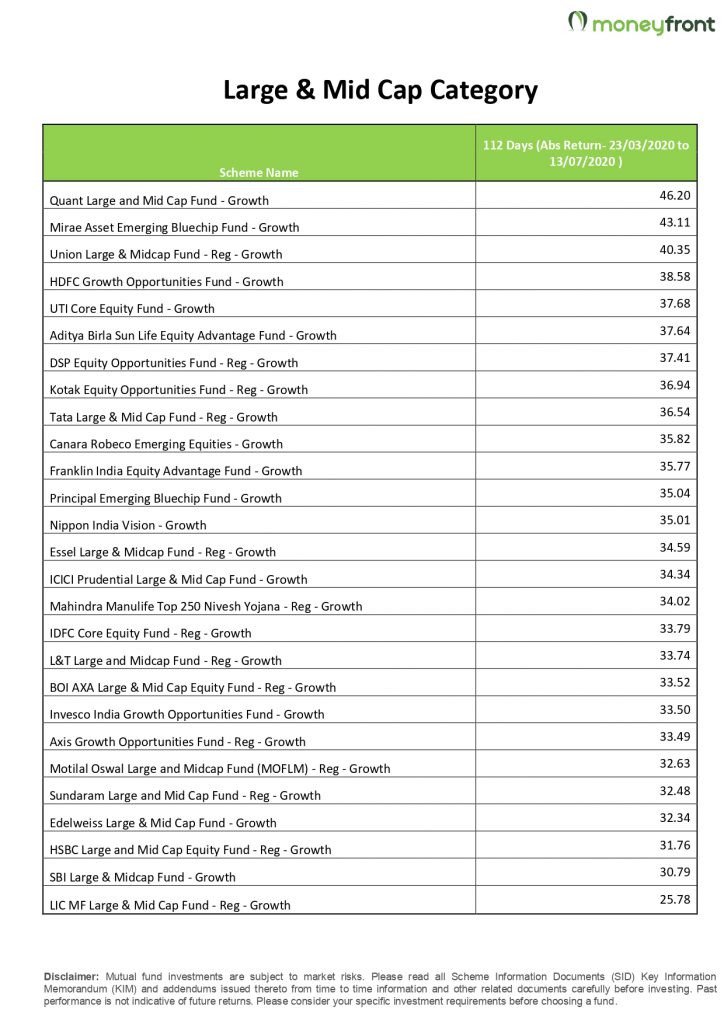

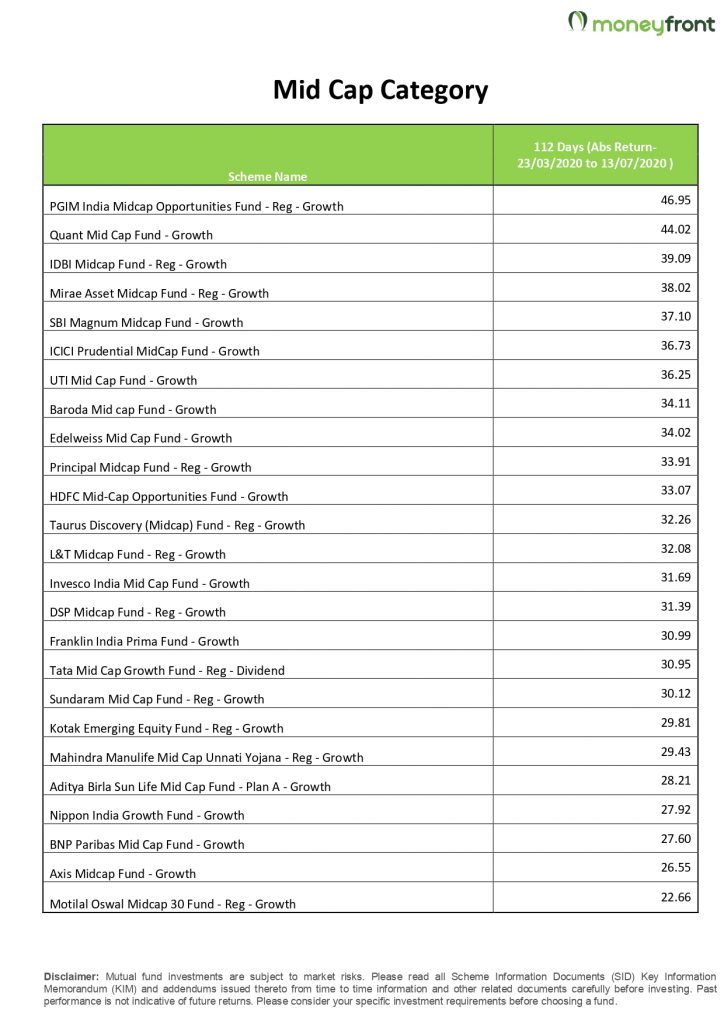

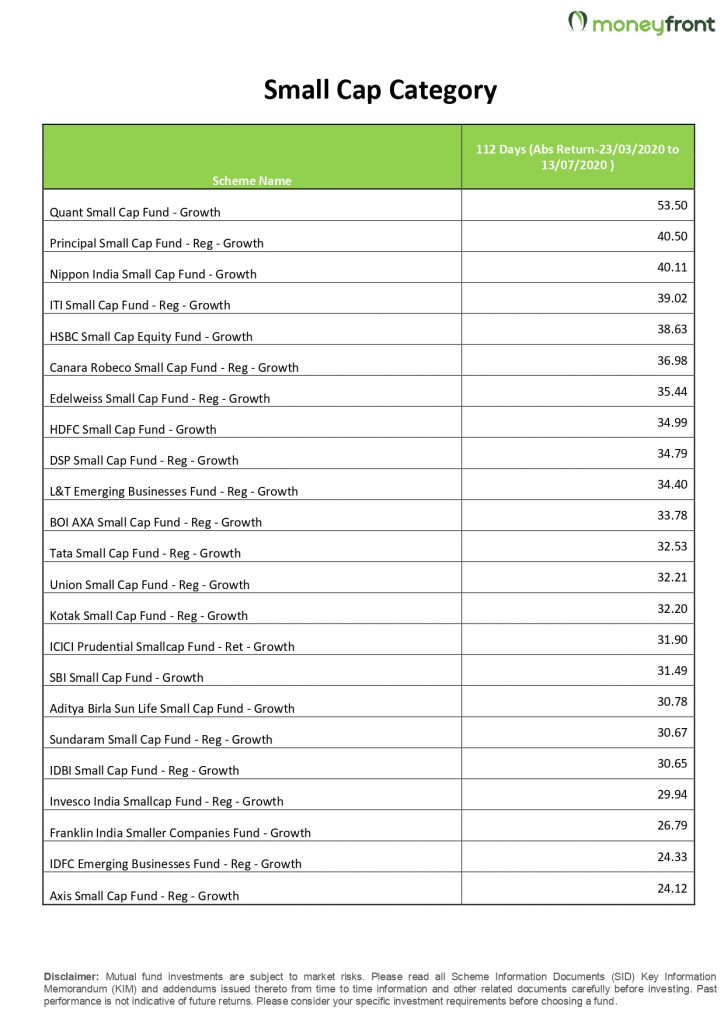

We do a deep-dive into each category of Mutual funds to try and decipher which are the schemes that are keeping up with the scorching pace of Index.

Attached herewith are few images analysing absolute returns of 160 schemes across all major categories of Equity funds in these 112 days.

Key findings:

- Large Cap

- Not a single large Cap scheme has been able to beat the index in this time frame.

- 17 schemes underperformed the index by atleast 5% or more in absolute returns.

- Multi Cap

- Only 3 Multi Cap schemes have been able to beat the Nifty Index in this time frame.

- Out of the Top 5 schemes in this category, only Parag Parikh has AUM worth considering.

- 24 schemes were lagging the index by atleast 5% or more in terms of absolute returns.

- Large and Mid Cap + Focussed Category

- Only 5 schemes in both the categories have been able to beat the Nifty index.

- Mirae continues to dominate on the bounce-back across the above 2 categories.

- Mid Cap and Small Cap

- Only 2 schemes in Mid cap & 1 in small cap have beaten Nifty.

- Top 3 in Midcap segment and Top 7 in Small cap (barring 1) actually come from lesser known stables.

In a nutshell, we aren’t trying to predict any market behaviour with a mere 112 day summary. We just wish to draw investor attention to a few critical aspects around investing and specially around Mutual fund investing. Summarising the same below:

1. Markets will continue to surprise on either side. No one predicted the sharp upswing of last 112 days. Be prepared for the unknown and it’s always good to stay invested as per your decided asset allocation.

2. Index funds are great options in any portfolio. They have inherent advantage of low cost and auto-rebalancing to represent the best in market. Significant chunk of Large Cap allocation in a portfolio should move to Index funds.

3. In this upswing, out of a large group of 160 schemes, only 9 were able to beat the Nifty Index.

4. It’s good to track performance – but its futile to chase performance. Case in point being Axis schemes – which have been blue-eyed schemes on the street. Across all categories, Axis has been lingering at the bottom of ladder in this recovery phase of Markets.

5. Top quartile performers in MF industry shuffle every 6-12 months. One has to stick with schemes & plan for atleast 2-3 years, before taking a rebalancing call.

6. Consistency is always more important than being top performer for a particular period. Precisely for this reason, we have ignored sectoral and thematic schemes in this analysis as few of the Pharma schemes or Global funds are looking extremely tempting in the current run-up.

Finally, we would like to conclude by saying that 112 day analysis is no benchmark to classify any scheme good or bad. It’s a mere indicator to highlight that schemes go through phases of underperformance & outperformance when compared to the Index.

It is also an indication that the best schemes can have depressingly bad days and worst schemes can have brilliantly good days. One has to avoid temptations of chopping and churning portfolios, chasing best performing schemes and being a topper at all times because a single scheme rarely does that in all periods. Consistency or simply put having schemes with more good days than bad, is the key to a good portfolio.

Equally important is to avoid timing the market. Time and again, such sharp rallies re-emphasise that markets have a mood of their own and its futile to correlate this mood with the state of economy. As Peter Lynch famously put it – “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

As a footnote – we continue to hold our fundamental view on the markets. At the risk of being reiterative, we will end this note with a few golden rules of Personal finance that are becoming even more relevant as the crisis unfolds:

- Too many changes in the portfolio are unnecessary

- Chasing top performers is not a sustainable strategy

- Believe in index funds

- Stick to your asset allocation at all times

- Sitting in cash can be hazardous to portfolio health