We are in the month of March 2022, and tax savings are on the mind of every single taxpayer, salaried or non-salaried. So how can a tax-saving investment prove to be beneficial to an investor? Such investments are beneficial when they help the investor to earn a tax-free income in addition to providing them the benefit of tax exemption too. So, why wait for the financial year to end to make such investments? One should act smartly and begin investing right at the start of any financial year as this ensures you have sufficient time for financial planning and maximizing returns. So, how do you choose the perfect tax-saving investment option for yourself? There are a lot of factors including return size, liquidity, safety, etc., that must be considered prior to make an investment. There are a lot of tax-saving investment options that come u/s 80C of the Income Tax Act, having the maximum tax exemption limit of Rs.1,50,000, such as Public Provident Fund, ELSS (Equity Linked Saving Scheme), Fixed Deposits, Life Insurance, ULIPs, National Savings Scheme, and the like. Let us have a look into some of these and understand how they differ from each other.

1. ELSS (Equity Linked Saving Scheme)

An ELSS fund is one such mutual fund that offers tax exemption u/s 80C. In an ELSS fund, the exposure is mainly in equity/equity-linked stocks, followed by fixed-income securities. The lock-in period for an ELSS is just 3 years and there is no upper cap on the amount to be invested. These two features make this scheme quite attractive in contrast to other schemes. If you invest in an ELSS, you not only benefit from tax deduction but also wealth creation.

2. Public Provident Fund (PPF)

This is one of the safest investment options and is good for those looking to save tax as well as get guaranteed returns by way of interest (currently at 7.1%), on their investment. A PPF account can be opened with just Rs.100. The minimum period of investment in PPF is 15 years and this can be extended in 5-year slabs if you desire. Another interesting part is that you can invest a minimal amount of Rs.500. However, note that any investment made above Rs.1.5 lakh will be exempted from tax. You can opt for lumpsum payment or via installments. This investment option is a good bet for risk-averse investors.

3. Tax-Saver FD

One of the popular investment options for years has been none other than Fixed deposits! An FD is not affected by the ups and downs of the market and will have a fixed interest rate at the time of maturity of the investment. However, if the interest rate is lower than what you could earn by way of investing in mutual funds or stocks, you could end up earning lesser returns on your money. Tax-saving FDs are preferred by a lot of risk-averse individuals as they offer tax exemption benefits u/s 80C and they come with a 5-year minimum lock-in period.

4. National Saving Scheme (NSC)

The NSC is a low-risk investment that can be opened by an individual at any post office, the minimum amount of investment being Rs.1,000. The lock-in period for the NSCs is 5 years, and though you invest in any number of NSCs, remember that investments up to only Rs.1.5 lakh will give you the benefits of tax deduction u/s 80C. You can earn on your investment by way of fixed interest (currently at 6.8% p.a.). The government keeps revising the interest rate regularly. NSC is a safe investment that provides offers guaranteed returns by way of interest as well as total capital protection. But the NSC will not be able to give you inflation-beating returns in contrast to the National Pension Scheme or tax-saving mutual funds.

5. Unit Linked Insurance Plan (ULIP)

If you are keen on an investment option that invests in insurance, equities and also offers tax benefits, then ULIPs are a perfect choice. In a ULIP, a portion of the premium is invested in securities or bonds and the remaining amount is invested in insurance.

ULIPs offer the investors a dual benefit, i.e., the premium paid is eligible for a tax deduction u/s 80C and the returns earned on maturity are also exempt from tax u/s 10(10D). The lock-in period for this scheme is 5 years. ULIPs are good investment options for those who have long-term goals such as marriage expenses, buying a car, house, etc., due to the principle of compounding.

6. National Pension Scheme (NPS)

The National Pension Scheme is a pension program and this option can be availed by employees from private, public, as well as unorganized sectors, except for the armed forces, falling in the age group of 18-60 years. A portion of your funds invested in the NPS is invested in equities, which makes this scheme offer higher returns in contrast to that offered by options such as PPF.

The maximum deduction claimed u/s 80CCD(1) is just 10% of the salary, restricted to the limit of Rs.1.5 lacs. For self-employed taxpayers, the maximum deduction claimed is 20% of their gross income. Also, existing subscribers can benefit from the additional deduction u/s 80CCD(1B) and claim Rs.50,000 additional deduction by splitting their contribution in NPS, thereby claiming partly in 80C and partly in 80CCD(1B). This will give them the benefit of tax deduction of up to Rs.2 lakhs.

7. Post Office Term Deposit

This type of investment option has been quite a popular one in terms of savings. This account can be opened by anyone with a minimum investment of Rs.1000. Also, it offers an attractive interest rate, which at times, could be higher than that offered by your Bank FD. Furthermore, an account can be opened even in the name of a minor account and the operation can be done by its guardian. A person can open numerous post office deposit accounts. The tenure for this account can be 1 year, 2 years, 3 years, or 5 years, and the interest rate varies according to the tenure. Any deposit that is held for 5 years or more becomes eligible for tax benefits u/s 80C.

8. Senior Citizen Saving Scheme

If you are looking for a government-backed scheme that offers retirement benefits, then this is a good option for Senior citizen residents in India. It is one of the schemes under the Post Office Savings Scheme. The investment in this scheme can be a lump sum and can be done jointly or individually. An account holder can have one or more accounts under this scheme, however, they must ensure that the deposits made in all accounts together must not exceed Rs.15 lakh (the maximum limit). Any senior citizen aged 60 years or above, or those who opted for Superannuation or VRS in the age bracket 55-60 years, or retired defense personnel aged between 50-60 years can opt for this scheme. It also is eligible for income tax deduction u/s 80C.

9. Sukanya Samriddhi Account

This account can be opened by parents or even legal guardians of a girl child below the age of 10. Also, for a family, only 2 accounts are permitted under this scheme, and for one girl child, only one account can be opened. This scheme offers a high-interest rate in contrast to other schemes that are government-backed (currently it offers 7.60% for the quarter ending March 2022). It offers tax deduction benefits u/s 80C up to Rs. 1.5 lakhs per annum. If you are looking for a great investment for the long term, this is a great option as it offers the benefits of compounding. You can deposit an amount as low as Rs.250 or a maximum of Rs.1.5 lakhs annually.

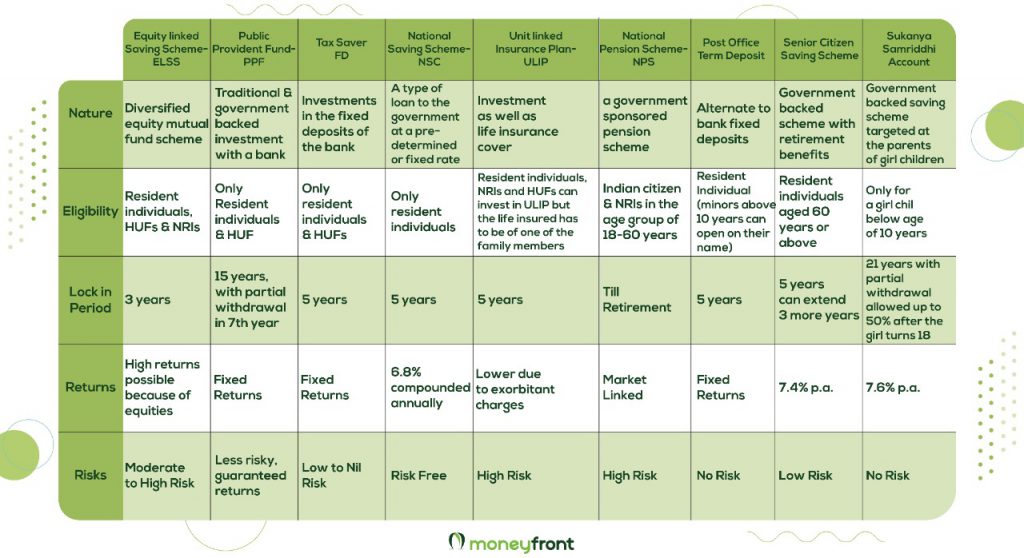

The chart below has been created, to sum up, and simplify the differences between all the above-mentioned investment options available u/s 80C:

Hope this helps you choose the right instrument to avail yourself tax benefits u/s 80 C and direct your investments in the right way!