Here’s a quick snippet of 2020 – year which left the imprint, memories and lessons of a life-time for each one of us in general and investors in specific.

Key highlights of the year:

- Shortest Bear Market

- Ferocious Bull run

- Global lockdown

- Brexit

- Oil went negative

- Unprecedented US elections

- PANDEMIC !!

- And fastest ever Vaccine !!

Key events with respective lessons from Equities:

- Nifty on 14th Jan – 12362; Nifty on 23rd March – 7610; Nifty current (6th Jan) – 14146

- Markets can surprise with speed and momentum on either extremes. Patience and Calmness is the key to tackle such volatility

- Fall of 38% from peak and then bounce of 86% from the lows all in a matter of 12 months !

- There is no point timing entry & exit – not a single investor could get the peak & trough right. In hindsight staying put was the best option

- Bounce was initially only an index rally (selective large caps) and then last 3-4 months have seen mid/small momentum

- Its never good to stick only with one category. Diversification is the key and ultimately a well-diversified portfolio scores above all.

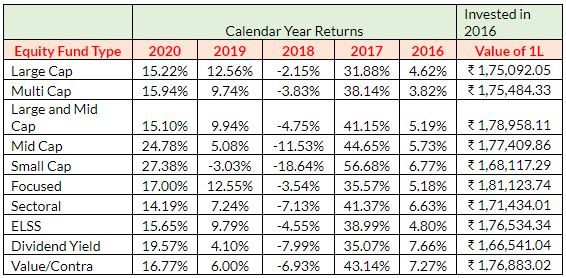

- But the best categories YTD in terms of returns have been Mid & Small cap

- Mid/Small caps can be highly volatile which is evident from last 3-5 year returns of the category (See the data below). But investors who stick around are ultimately rewarded.

- Active Vs Passive Debate

- Consistent underperformance of Active funds has led to big shift towards the Index/ETF categories. We have written few notes on the same before as well.

- Big Multicap Saga

- Never react in panic. SEBI quickly came out with the option of Flexi cap category and most of the funds are now re-classifying into flexi cap. Investors who went for knee-jerk reaction and redeemed from Multicaps suffered.

- Slew of NFOs (global funds, ESG etc)

- Cut the clutter. Avoid the rat race. Buy only what is required for your financial goals or portfolio diversification.

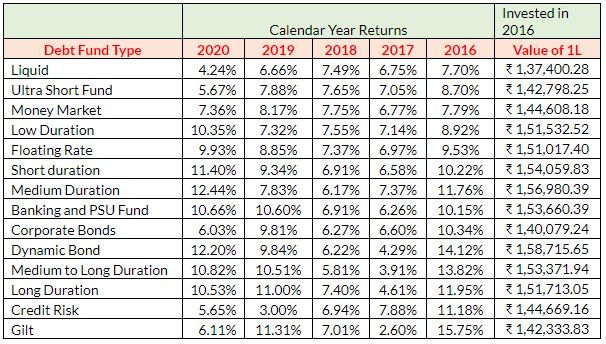

Key events with respective lessons from Debt:

- New lows on Interest rates. Debt can also make great returns

- Never fight with Macros – historic lows on interest rates could never have been predicted. It also marked a super normal year of returns for most of the debt categories

- Franklin Saga

- Six schemes of FT go into quarantine. Always pay attention to red flags and remember debt funds can also be risky !

- Negative returns in Liquid funds in March

- Dramatic mayhem in debt markets, complete credit squeeze and very low confidence in corporate papers resulted in liquid going negative for almost a week. Nothing in this world is safe !!

- Segregated portfolios is the new norm

- Fund houses have proactively carved out downgraded (or defaulted papers) to safeguard interests of existing investors. All that glitters is not gold.

Key events with respective lessons from other asset classes:

- Gold after a fantastic rally for last 2 years and first half of 2020 has stabilised or albeit corrected now.

- No asset class can go one way up for long. Never invest looking at past 1yr returns

- Arbitrage was the most volatile category with swing from negative to double digit returns

- Understand the risks completely before investing into any category or scheme

- Last but the biggest of all – Oil drama

- Oil futures went negative for a brief while, just highlighting that nothing is unimaginable when it comes to vagaries of financial markets.

Data across categories for last 5 Calendar years:

In nutshell:

“You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.”

— Peter Lynch

Wishing you and your families the very best in 2021 from Moneyfront Family.

Thankyou soo much moneyfront team for providing such a informative article on key events 2020.