For most investors in India, mutual funds are one of the most preferred investment options. They offer a great way to add more diversity to your investment portfolio and give you a steady source of returns.

However, calculating the returns is one of the challenges that most investors face. If you are getting low returns consistently, it is perhaps time to exit from the fund.

There are a few different ways to compute the returns by taking into account the NAV of the mutual fund. NAV or the Net Asset Value refers to the price of purchasing one unit of a mutual fund. NAV is computed daily at the end of each trading day.

Here is a handy guide on the various methods of calculating mutual fund returns:

Annual returns: True to its name, this return is calculated on a yearly basis. It is expressed as an annual percentage of the profits or losses made from your investment over a period of one year. Annual return is a helpful indicator of how a mutual fund is performing in a given year.

The formula for calculating the annual return is straightforward:

Annual return = (NAV at the end of the investment – NAV at the beginning of investment) / NAV at the beginning

For example, if the NAV of the mutual fund was 1000 on January 1, 2021 and 1100 on 31st December 2021, the annual return for the year would be 1100 – 1000/1000 = 0.1 or 10 %

Alternatively, you can also use the formula below in excel to calculate the annual return:

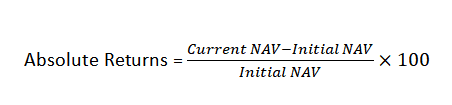

Absolute returns: This allows you to assess simple returns made on your initial investment. In case the holding period is less than 12 months, it is advisable to use absolute returns to determine your gains or losses over a period of time.

The formula for calculating the absolute returns is [(NAV at present – NAV in the beginning) / NAV in the beginning] x 100

For example, if you purchase units of a mutual fund on April 25th, 2021 with NAV of 200 and on May 25th, 2021 the NAV rises to 210, then the absolute returns for this duration is 210 – 200/200 x 100 = 0.1 x 100 = 10%

You can use the formula for absolute returns to know the returns at any point of time during the year — this is in contrast to the formula for annual returns that only allows you to calculate it for the end of the year.

As there is no compounding effect of this formula, it is not used to assess the fund’s performance.

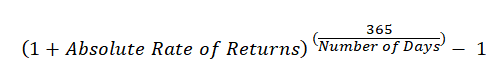

Alternatively, you can also use the formula below on excel to calculate the absolute return:

Compounded Annual Growth Rate:

When your investments are for a period of more than one year, you can use the Compounded Annual Growth Rate to know the returns. This formula enables you to know the mean annual growth of a fund over the entire investment horizon.

CAGR accounts for the interest on the investment as well on the accrued interest. It can also provide a better assessment of a mutual fund as it shows you the time value of money and accounts for volatile returns.

The formula for calculating the CAGR is:

(Ending Value / Starting Value)(1/N) – 1

XIRR:

When you want to calculate the returns on SIPs made for your mutual fund investment, using the XIRR (Extended Internal Rate of Return) function on Excel is useful. XIRR indicates the Internal Rate of Return for cash flows that take place at different intervals.

The following data is needed to operate the XIRR function on Excel:

- SIP

- Dates of when the SIP is made

- Redemption date; and

- Redemption Amount

XIRR is useful when you want a consolidated return for investments for irregular cash flows.

Final Words

While you can use these formulae for both lump sum and SIP investments in mutual funds, the choice of method will depend on what you want to calculate as each of them has a unique purpose. You can also use the readymade mutual fund returns calculator available online on investment platforms.