Article shared by Quantum Mutual Fund

Equity markets are experiencing a bull run, investors may be worried about the impact of rich valuations on their investments. Unfortunately, this can often lead to investors making hasty decisions or mistakes, thereby exposing their portfolios to downside risks. Explore how investors can respond to this bull run and balance their equity portfolio.

1. Avoid untimely redemptions: Unless investors are nearing their goals, they should avoid making untimely redemptions on their mutual fund investments either partially or fully. Investors making untimely redemptions to time the market and pulling out their money based on the market conditions or economic environment end up hurting their wealth creation journey.

Investors need to stay focused on their financial goals, which is in tandem with their risk profile, investment objective, and the time at hand to achieve the envisioned financial goals. For short-term investment, investors can invest in liquid funds, which can also meet emergency needs and help investors resist the urge from tapping into their investments meant for long-term wealth creation goals.

Investors about to reach their financial goal can use an STP (Systematic Transfer Plan) to gradually move their money from a riskier asset class like equity to a comparatively lesser risky asset class like Liquid Funds.

Avoid entering the bull run to make short-term profits and worrying over the right time to enter and exit the market. Investors can invest for the long term as time spent in the market helps earn risk-adjusted returns.

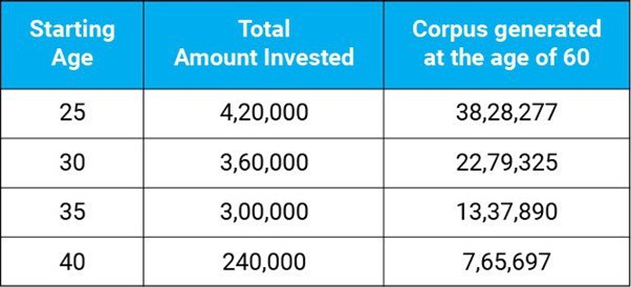

For instance, consider how a SIP (Systematic Investment Plan) of just Rs.1000 per month for retirement would have fared over the long-term at an assumed 10% rate of return.

The above table is for illustration purposes only. Investments through SIP are subject to market risk and do not assure a profit or returns or protection against a loss in a downturn market.

2. Avoid stopping SIPs: Investors investing through a lumpsum mode can stagger their investments during a bull run. For instance, investors can invest 75% now and 25% when the markets experience a correction. If an investor starts a SIP (Systematic Investment Plan) in equity mutual funds, they need not worry about the market levels. A SIP brings in rupee cost averaging, which averages their investment costs as they buy more units when markets are falling and less when markets are rising and free themselves from the need to time the market. Instead of stopping SIP and redeeming one’s investments, an investor can pause SIP and stay invested to be on track to achieving their goals.

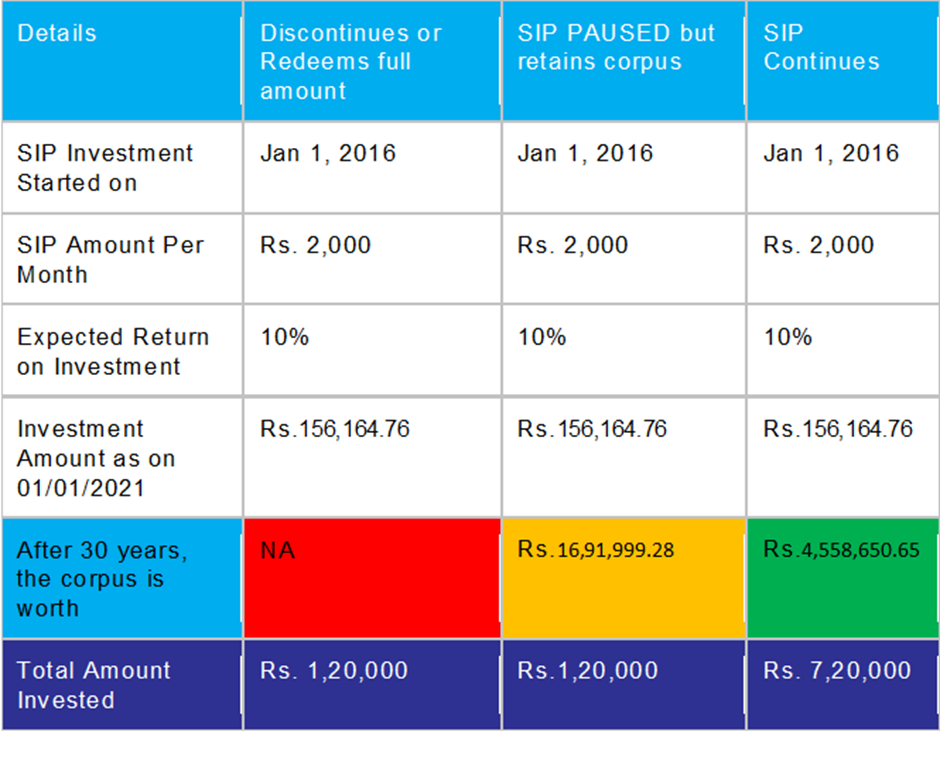

Let’s consider this hypothetical example of an investor who has a goal of saving for his retirement.

Assume he has started a SIP option of investing at Rs.2000 per month at an assumed rate of return of 10% CAGR. He has three choices with regards to his SIP investments: CONTINUE, PAUSE, DISCONTINUE or REDEEM his SIP.

Note: The table is for illustrative purposes only. Investments through SIP are subject to market risk and do not assure a profit or returns or protection against a loss in a downturn market.

If the investor needs funds, he should PAUSE further contributions to the SIP, however, stay invested to the extent possible so that he can grow his wealth for future goals.

The advantages of staying invested through a SIP are:

- Brings discipline: Helps investors invest in a timely and organized manner.

- Avoid timing markets: Investors are free from the need to time to markets.

- Rupee cost averaging: An SIP buys more units when the market is low and lesser when the market is high, bringing down the investor’s average cost per unit.

- Power of Compounding: Investors can make the most of the compounding effect to achieve long term goals

3. Avoid herd mentality: Instead of following the herd mentality and oversubscribing to popular IPOs or investing in NFOs, investors need to weigh the relevance of their allocation to their financial goals.

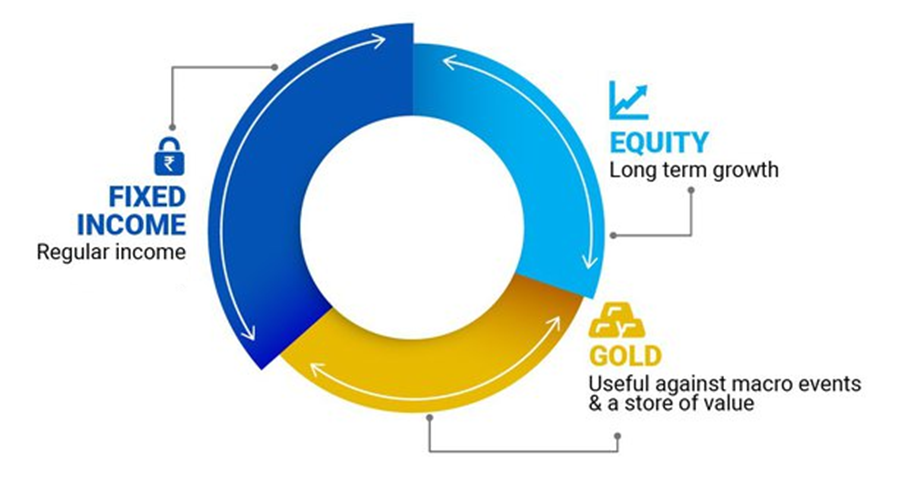

4. Avoid concentration of assets: During a bullish market, there may be chances that investor keeps adding to their equity allocation, thereby skewing their allocation to equity while having little or no allocation to other assets such as debt or gold.

Investing in just one asset class could hamper an investor’s financial goals. By strategically diversifying assets across asset classes, one can minimize the risk of a bad outcome.

Investors need a prudent asset allocation to minimize downside risks and give them the potential to achieve their goals.

Asset allocation means dividing up assets in the right proportions among equities, debt, bonds, and gold to maximize one’s chance of achieving their financial goal while controlling investment risk.

To start with, investors can consider emergency funds at the heart of their portfolios. These funds help tide over unforeseen expenses such as a medical emergency. Investors may consider liquid funds as part of their emergency funds. Liquid funds can be easily liquidated as cash. These funds predominantly invest in liquid money market and debt securities that are of the short duration of up to 91 days and most importantly, offer high liquidity. During these uncertain times, investors may consider an emergency corpus that is enough to meet 12 months of expenses or more, depending on their risk profile. After setting aside the emergency corpus, investors can then allocate to equity and gold.

Investors can consider allocating 80% of their investment towards a diversified equity portfolio. While selecting one’s equity allocation, ensure that the underlying portfolio doesn’t overlap between two funds. Investors need to take care to see that their portfolio is diversified across market capitalization and investing styles. Investors can also consider allocating 20% of their investment to gold which acts as a store of value and a good portfolio diversifier. Investors can invest in liquid and price-efficient forms of gold investment such as Gold ETFs or Gold Fund of Funds.

Please note that the above-suggested fund allocation only and is not to be considered as investment advice/recommendation, please seek independent professional advice, and arrive at an informed investment decision before making any investments.

5. Avoid chasing returns: While returns are one part to assess one’s portfolio, investors should not solely adjust their portfolio on the basis of returns and should avoid taking upon high risk in the process. Investors need to periodically reassess their portfolios and determine the allocation to different assets.

Rebalancing one’s portfolio will help eliminate the need to predict the near-term future of the financial markets. In addition, it reduces dependency on a single asset class to generate returns. Investors who find the process of rebalancing cumbersome can take advantage of Multi-Asset Fund of Funds where the fund managers periodically rebalance the underlying assets depending on the market conditions.

Disclaimer: The views expressed here in this Article / Video are for general information and reading purposes only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide/investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The Article / Video has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as of date. Readers of the Article / Video should rely on information/data arising out of their own investigations and be advised to seek independent professional advice and arrive at an informed decision before making any investments. None of the Quantum Advisors, Quantum AMC, Quantum Trustee or Quantum Mutual Fund, their Affiliates, or Representative shall be liable for any direct, indirect, special, incidental, consequential, punitive, or exemplary losses or damages including lost profits arising in any way on account of any action taken basis the data/information/views provided in the Article/video.

Mutual Fund investments are subject to market risks, read all scheme-related documents carefully.