We need to invest in an array of financial instruments to meet various challenges in the future, amongst which, inflation is quite a tough contender.

Savings have always been synonymous with bank account savings or fixed deposits, wherein the rate of interest was the attraction. However, of late, bank deposits are not an appealing option; equities have taken over as the preferred mode of investment. We are aware that the value of a rupee today would not be the same, few years down the line, given the rate of inflation. Investments are a way of ensuring that money is invested wisely, rather than lying idle in bank accounts based on the current low rate of interest.

We need to invest in an array of financial instruments to meet various challenges in the future, amongst which, inflation is quite a tough contender. Every single financial instrument aims at beating inflation. However, the question that arises is, can we really beat inflation? will staying invested for the long term play an important role in this? Before we dive into the answers to these questions, let’s brush up on some of the basics.

What is inflation?

Inflation, an economic term, that talks about the climb in prices over a certain period of time. It is a measure of the average prices of goods and services. Inflation leads to a fall in the value of money, which means that Rs.1000 might not be able to buy you the same amount of goods/services 10 years down the line, as what it can buy you today. Inflation occurs due to severe economic changes in a country, of which two main factors are the rise in wages and the expeditious increase in the demand for raw materials such as oil.

How to hedge against inflation?

One way of hedging against inflation is by having long-term investments in equity instruments. According to experts, one aspect that must be borne in mind while setting your investment goals is that inflation rises to about 6-7 percent per annum. Hence in order to beat inflation during the investment horizon, the return on investment (ROI) has to be greater than 6-7%. Investing in long-term equity must be done cautiously as in case the return at maturity is not greater than the rate of inflation at that time, the whole purpose of beating inflation gets quashed.

It is important to be very clear about investment goals when the investment is for the long run. For instance, if the investment goal is related to health or education, then the rate of inflation to be considered is around 10%. Experts indicate that asset allocation is crucial, and, at present, neither government-backed schemes nor bank FDs are able to give investors a yield greater than 7%. Yes, they are safe bets for conservative investors. So the choice to earn a substantial amount of return gets limited to making investments in either gold, equity, or real estate.

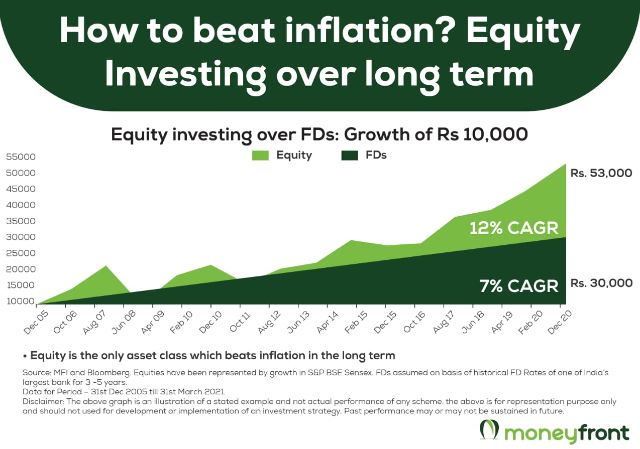

The chart below is a simple explanation of how investment in equity has fared over the years in comparison to investment in Bank FDs. A good way of understanding returns is by comparing the Compounding Annual Growth Rate (CAGR) of investments made in different financial instruments. An investment of Rs 10,000 made inequities in December 2005 has seen a CAGR of 12% in contrast to an investment of the same amount made in fixed deposits. If you observe the chart carefully, you will see that an investment of Rs 10,000 made inequities in Dec 2005 grew to Rs 20,000 in August 2007, whereas FDs just grew to Rs 11,000. Similarly, when the same amount was invested for a longer duration of 15 years inequities, the amount grew to Rs 53,000, whereas the FD grew to just Rs 25,000. Equities can be riskier in contrast to FDs as they are subject to market risks, but, if you are driven by risk, the chart is self-explanatory!

In short, inflation has lost the battle with stock markets, especially in long-term equity investments. In the short term, the markets display a lot of volatility. Let’s have a look at the last year-2020 and the current year 2021 – the markets have been in a frenzy and the pandemic has shown us not just the lows of the market but also the highs. In January 2020, Sensex was around 40,000 and in March 2020, the pandemic outburst had a major impact on the markets and almost every single stock came crashing down with Sensex reaching a level of 25,000 in a span of just 2 months! However, the markets recovered in a span of 5-6 months, and in January 2021, Sensex was crossing 51,000!

Those who invested their money in equities during this period reaped good profits! This shows that equity is one such class of asset that can beat inflation and help investors earn positive returns if they stay invested for the long term. Another reason for considering equity investments is liquidation. With almost every investor having a Demat account these days, the process of buying and selling stocks has been simplified. The process of selling Mutual Funds is anyways fairly simple. On the contrary, liquidation isn’t quite simple in alternative investment options like real estate.

Conclusion

One must remember that the impact of inflation differs in debt and equity investments. A rise in inflation hikes the rate of interest and lowers the cost of long-term bonds. Furthermore, in fixed deposits, a rise in inflation leads to the loss of purchasing power on investments. If you go back in time and have a look at the performance of equities, you will notice that even if there was a short spike in inflation, equities have performed well.

What is important is that investors must allocate their assets wisely, post-understanding their long-term and short-term goals, their risk appetite, and proper research of the financial instruments for investment. To sum it up, having well-researched investments inequities that consider all your goals and portfolio diversification can help an investor beat inflation.