Article Shared by Edelweiss AMC

Compounding, varyingly addressed as the ‘magic of investing’ and the ‘eighth wonder of the world’ can play a significant role in your wealth creation journey. The best thing about compounding is that while it can have an immense impact on the growth of your investments, it is quite simple to understand.

So, what exactly is the power of compounding?

Speaking in mathematical terms, it is ‘the increase in the value of an investment due to the interest earned on the principal and the accumulated interest.’

Simply speaking, compounding is the process that helps you earn interest on the principal amount that you have invested and also on the interest that you earn periodically.

To truly understand the power of compounding, let’s compare compound interest with simple interest.

If you are earning simple interest on an investment, then you earn interest only on the principal amount invested. However, if you are earning compound interest then you will earn interest on the principal amount invested and on the accumulated interest amount over successive periods. Over time, this interest on interest can snowball into a substantial amount.

Let’s take an example to understand this better.

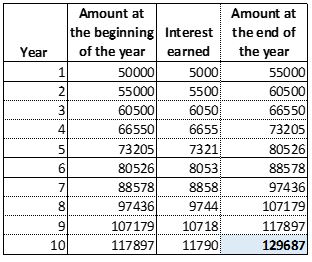

Rahul and Neha both invest Rs. 50,000 (P) at the rate of 10% (R) for 10 years (T). While Rahul chooses simple interest, Neha opts for compound interest.

Amount earned by Rahul = P x (1+RT)

= 50000 x (1 +10% x 10)

= 50000 x 2 = Rs. 1,00,000

Amount earned by Neha

= (1+rate of return)(no. of years invested x principle amount)

= (1,10)(10 x 50,00) = ~Rs. 1,30,000

Table 1: Calculation for Compounded Annual Returns

Benefits of the power of compounding

The main benefit of compounding is that it gives you an opportunity to exponentially grow the returns from your investments. More importantly, it teaches you the importance of time. As your investment time period increases so do the benefits from compounding. This is because, with time, you gain returns which are then reinvested to generate more returns. As you stay invested, these reinvested returns generate more returns.

Clearly, compound interest can help you amplify your investment returns. However, by investing a fixed amount on a periodic basis you can further harness the benefits of compounding. This can be easily achieved by investing via the systematic investment plan (SIP) route. A SIP allows you to invest a fixed amount of money into a mutual fund scheme of your choice and at time intervals that suit you best. These could be fortnightly, monthly, or even quarterly. Since a SIP facilitates the regular investment of a fixed amount of money, it can help you reap the benefits of compounding.

Assume that you invest R. 5000 in a monthly Systematic Investment Plan (SIP) for a mutual fund at 10% per annum for a period of 5, 10, 15, 20, and 25 years. Below, we see how these investments grow.

Table 2: Growth in monthly investments over different time periods

| Monthly SIP | Rate of return | Total amount invested (Rs) | Investment time period (years) | Total amount at the end of investment period (INR) |

| 5000 | 10% | 300000 | 5 | 3,90,412 |

| 5000 | 10% | 600000 | 10 | 10,32,760 |

| 5000 | 10% | 900000 | 15 | 20,89,621 |

| 5000 | 10% | 1200000 | 20 | 38,28,485 |

| 5000 | 10% | 1500000 | 25 | 66,89,452 |

As you see from the above table, if you double the investment amount along with the time period, the total amount grows by more than double. This is the power of compounding.

One of the best things about the power of compounding is that it helps you grow your money even if you invest a small amount of money. You need not start big. You can start small, invest consistently, and stay invested over the long term to truly reap the benefits of compounding.

Niranjan Avasthi,

Head- Product & Marketing

Edelweiss AMC

An investor education initiative by Edelweiss Mutual Fund

All Mutual Fund Investors have to go through a one-time KYC process. Investors should deal only with Registered Mutual Fund (RMF). For more info on KYC, RMF, and procedure to lodge/redress any complaints, visit – https://www.edelweissmf.com/kyc-norms

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.